Portfolio Impact – Year 1

Social Finance Fund First Anniversary:

Embedding Positive Impact in Realize Fund I

May 29, 2024

Realize Capital Partners’ portfolio-construction and market-building efforts are off to a strong start, after just one year as a fund-of-funds manager with the Government of Canada’s Social Finance Fund.

Year 1: A Year of Building, Learning and Growing

After key foundational work of creating a strong team, good governance structures and a robust investment policy, we were able to quickly start delivering on our mandate.

- Building a portfolio of positive impact: Investments made to date show that broad impact is being embedded into the portfolio. We have invested and granted into 10 social finance intermediaries (SFIs) led by and serving Black communities, Indigenous communities, newcomers and refugees, women and communities outside of large urban centres who are targeting a variety of social and environmental challenges.

- Growing the social finance market: Through hundreds of conversations and connections, we strengthened our understanding of the challenges in the social finance market and how Realize Fund I can help address them. We established three committees: an Investment Advisory Committee, Governance Advisory Committee and Sector Advisory Committee; all three enhance our reach and support to the social purpose sector and social finance market. We began our technical assistance program this year with three organizations, which we think will have organizational-building and well as market-building impact.

Year 2: Widening our Reach and our Support

In addition to working to secure private capital to leverage the Government of Canada’s investment, Year 2 will see us:

- Continuing to build our reach to all regions in Canada in support of equity-deserving groups, with a particular focus on place-based and community investments in underinvested areas. This work may involve supporting emerging SFIs to become investment ready.

- Launching an impact measurement program for all SFIs in the Social Finance Fund. We will offer several services: group training and advanced workshops and hands-on support with implementing the Common Impact Data Standard.

“We appreciate the collaboration, creative ideas and critical advice shown by so many in this first year. The Social Finance Fund’s goals of strengthening and growing the social finance market while increasing social equity and advancing the UN Sustainable Development Goals are too important to be left to just us! We look forward to continuing to engage with many in order to continue to build a successful, impactful fund.”

Lars Boggild, portfolio manager, Realize Fund I

“I am pleased with the remarkable progress made by the fund managers for bringing the Social Finance Fund to life. Through their incredible efforts, investments are being made available and accessible to social finance intermediaries that support social purpose organizations across Canada. I look forward to seeing a stronger and more resilient social economy being built through the Fund.”

Jenna Sudds, Minister of Families, Children and Social Development

BUILDING A PORTFOLIO OF POSITIVE IMPACT

Realize Fund I

- 10 investments, totalling $40.2 Million

- Most investments are targeting Canada-wide impact although Western Canada is a specific focus for some. Year 2 is expected to see additional focus on other regions in Canada as we continue to drive broad-based access to social finance

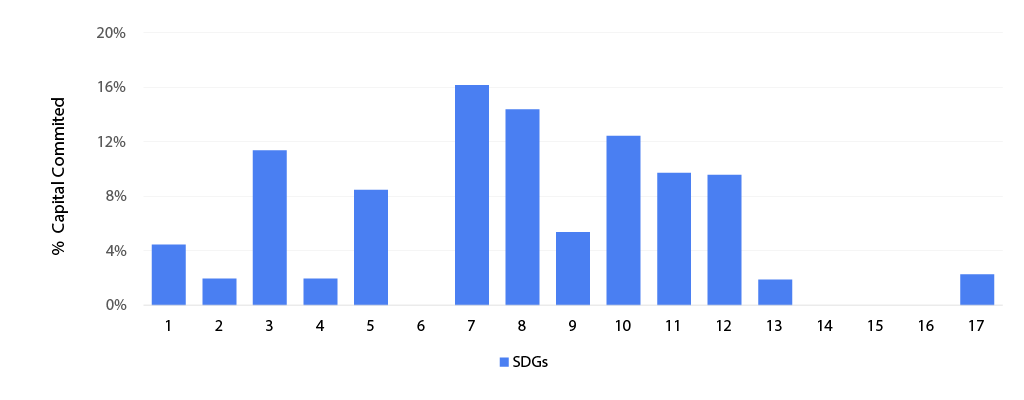

Investing in Support of the UN Sustainable Development Goals (SDGs) and Social Equity

We are building a portfolio to contribute to all UN Sustainable Development Goals. The first 10 investments are already offering broad SDG coverage. We expect the fund to contribute to more SDGs with future investments.

Year 1 SDG Contribution

Note: Based on capital committed at May 29, 2024. Weights add up to 100%. Investments may contribute to multiple SDGs

Investing in Support of Multifaceted Impacts

In addition to examining the SDG contributions of a holding, we measure a holding’s impact by developing a robust impact thesis and, through evidence-based fundamental analysis, tying the thesis to trackable metrics, outcomes and ultimate impacts. Portfolio investments in Year 1 are targeting broad impact in support of social equity and sustainable development, within a range of target outcomes as shown in the table below. We expect the outcomes list to grow as new investments are added to the portfolio.

| PORTFOLIO IMPACT OVERVIEW, YEAR 1 | % AUM |

|

Target Impact: Everyone’s fundamental requirements, like food, water, shelter, health care and education, are met. Current Target Outcomes:

|

34% |

|

Target Impact: The economy is resilient and low carbon, thereby addressing climate change. Current Target Outcomes:

|

31% |

|

Target Impact: Due to greater social equity, people are able to fully contribute to and benefit from economic and social progress. Current Target Outcomes:

|

29% |

|

Target Impact: With natural capital preserved, the earth’s regenerative capacity is maintained. Current Target Outcomes: Reducing waste generation through sustainable manufacturing |

6% |

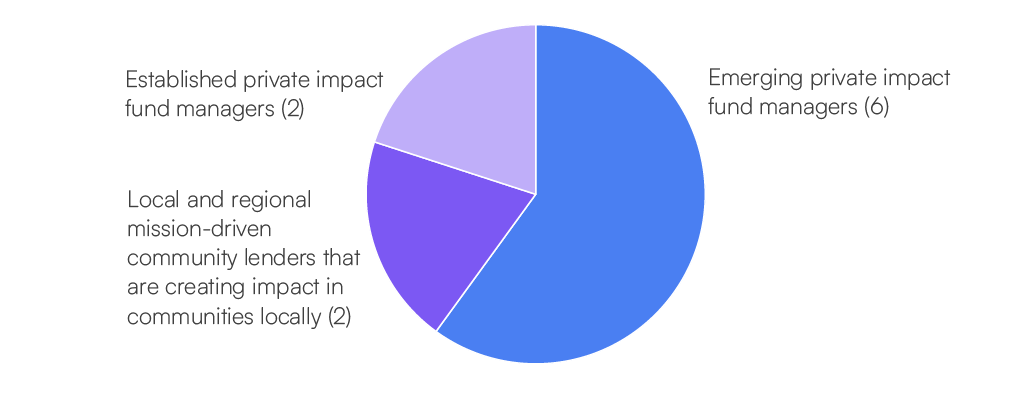

Investing in Line with our Investment Pillars

We have four investment pillars. In the first year, we invested in three pillars; the fourth, investing directly in social purpose organizations (SPOs), has been intentionally planned to happen later in our investment cycle. Of the 10 SFIs from this first year, 60% were in Pillar 2: Emerging private impact fund managers.

Year 1 Investment Pillars

GROWING THE SOCIAL FINANCE MARKET

We are growing the social finance market through technical assistance and an impact measurement program. In Year 1 we launched our technical assistance program and undertook extensive preparatory work for our impact measurement program.

Technical Assistance for Catalytic Results

Through intentional outreach, we are providing select assistance at both pre-investment and post-investment stage to new and emerging SFIs for whom we conclude our limited resources would be most catalytic and systemically impactful. We are aiming to uncover opportunities with, in and for traditionally underserved communities where there would be market-wide benefit. In our first year we supported three organizations:

- Black-led Afro-Caribbean Business Network (ACBN) provides Black businesses across Canada with resources to start, grow and scale up. We’re supporting ACBN to increase its capacity to prepare for and take on additional investment in its microloan program over the next couple of years.

- Relentless Pursuit Management is a woman-led fund manager whose Relentless Health Pursuit Fund aims to invest in companies that are developing technologies to address gaps in preventative health and chronic disease management associated with aging and has a strong track record of investing in leadership teams from equity-deserving groups. In addition to being an investor in the fund, we are providing assistance that will help support the fund manager’s capacity while it fundraises and forms its next fund.

- Woman-led Thrive Impact Fund provides loans to nonprofits, co-operatives and for-profit social enterprises in British Columbia that are generating positive social, environmental or cultural benefits. Our support will be used to increase the fund’s ability to work with other investors so it can grow its reach and impact.

On Track to Continue to Make Strong Contributions to Market Growth

While it’s only been a year and there is much still to be done, we are pleased with the contribution our capital is having to build the Canadian social finance market. As we look towards this next year and beyond, we are staying laser focused on meeting our long-term target outcomes.

Our overall target outcomes:

- Canada’s social finance participants are more diverse and capital allocation occurs in a more inclusive manner

- Communities have greater capital and decision-making control to address their own distinct and local challenges

- New impact investment funds enrich the social finance landscape, diversifying intermediaries and extending capital to underrepresented areas and populations

- Under-capitalized SPOs are accessing the capital needed to unleash their full potential

- Emerging social finance intermediaries are empowered with the technical skills, market knowledge and abilities necessary to successfully launch and manage impact investment funds

- Established social finance intermediaries leverage Realize Fund I’s catalytic investments to attract additional private sector investment

- A robust track record of market-rate returns across a diverse portfolio of investable opportunities has been substantiated, leading to sustainable private investment in Canada’s social finance market

- Increased private investment in Canada’s social finance market

- Social Finance Fund participants possess the essential skills, knowledge, and capabilities to measure and manage social and environmental impacts

- Social Finance Fund participants have adopted impact data standards, enabling the sharing, aggregation, and management of the social and environmental impacts of their investments while maintaining the flexibility to represent their unique impact models

A NOTE ABOUT REPORTING

At Realize Capital Partners, we assess, measure, manage and report on the impact of individual investments and Realize Fund I as a whole using the methodology developed by Rally Assets: the Rally Inclusive Impact Methodology (RIIM). As a fund-of-funds manager for the Social Finance Fund, we have specific data collection and reporting requirements for the Government of Canada, many of which are still in development; these will certainly be a part of our assessment and reporting process as well.

We encourage you to read the RIIM overview.