Impact Overview

Our investments in Realize Fund I and market-building activities are aimed at fostering systemic transformation to help develop a larger, more inclusive, more vibrant social finance market in Canada; one that is generating positive, lasting social and environmental impacts that address the nation’s big challenges.

This page offers a broad overview of our progress towards delivering on our intended outcomes. More detailed specific examples of our work can be found on our portfolio, insights and market-building pages.

This page is updated twice a year, with data as of June 30 and as of December 31.

Overview:

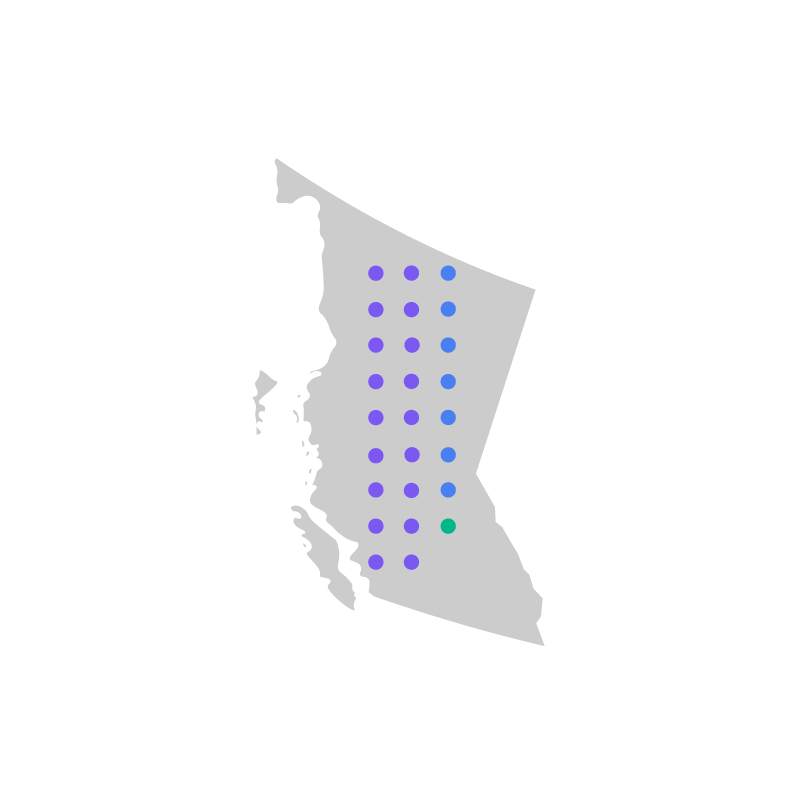

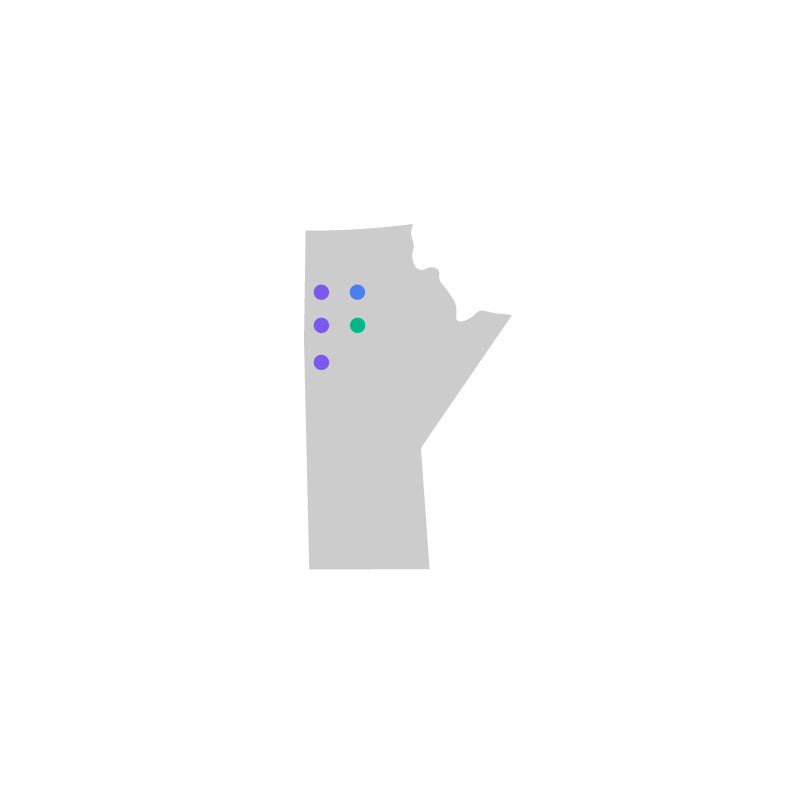

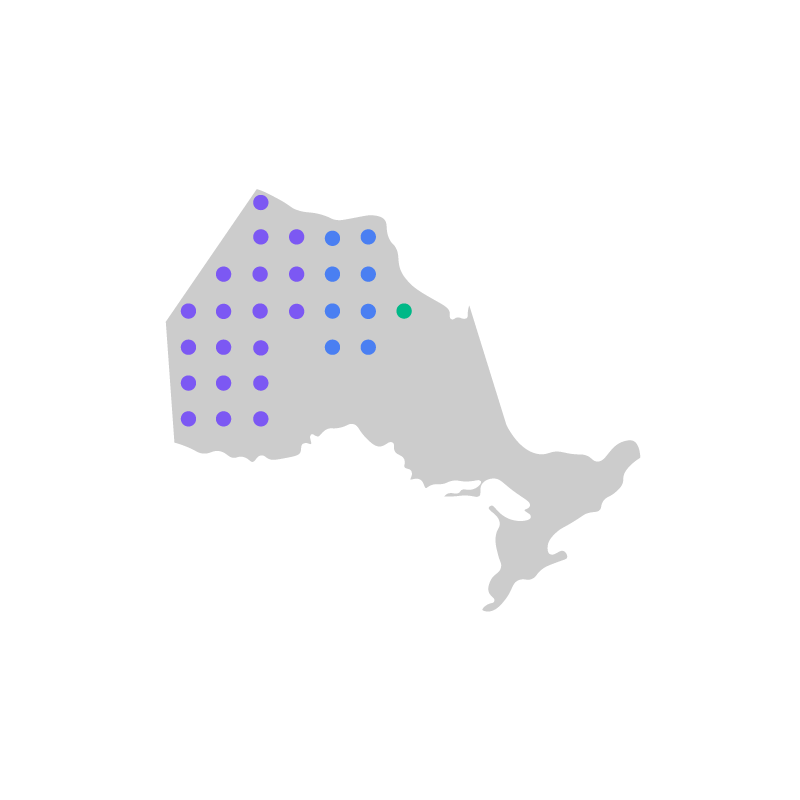

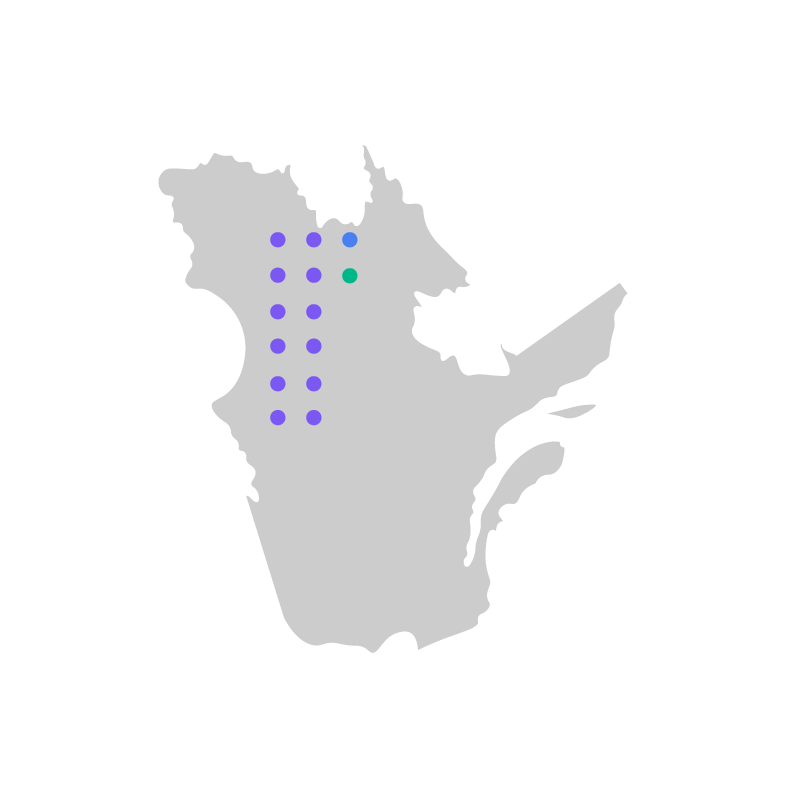

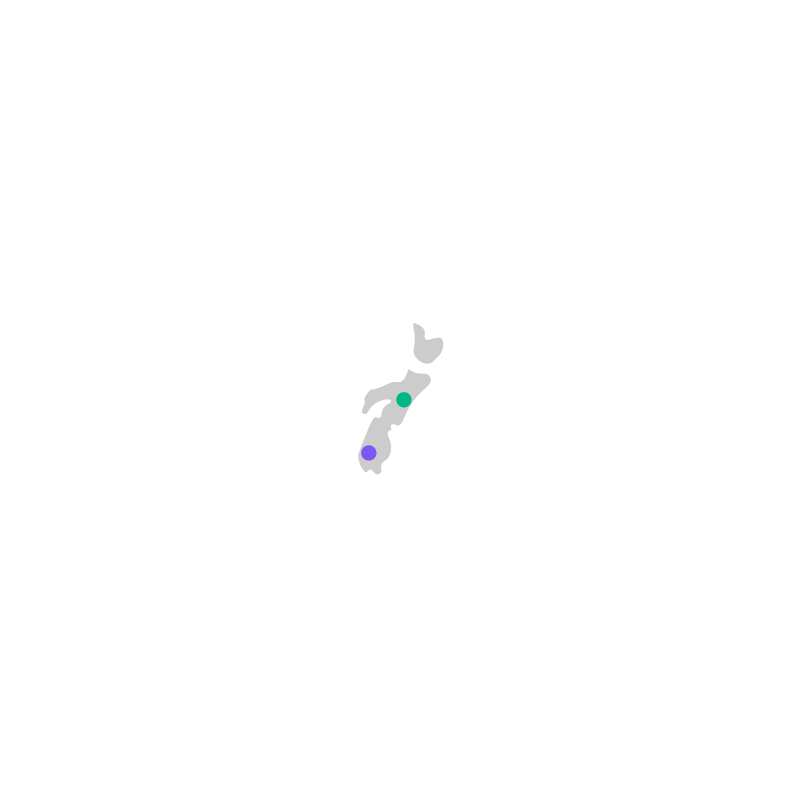

Geographic Reach

One of the long-term aims of the Social Finance Fund is to diversify the social finance market by investing in under-served regions. As this map shows, we are starting to do that, through our investments in Realize Fund I and through market-building activities.

Since we are still investing and most of the Realize Fund I SFIs are also still constructing portfolios, the geographic reach of investments will continue to grow.

Click into each province to learn more.

Provides a circular packaging solution for institutions and workplaces to track, return and reuse packaging at scale. Primary Impact Area: Waste Management Secondary Impact Areas: Climate Change Mitigation We have provided market-building support to 13 BC-based organizations, as of June 2025. An Indigenous-led digital platform offering Indigenous communities tools for elections, digital identification, and financial services to support self-governance, data sovereignty, and economic empowerment. Primary Impact Area: Racial Equity Secondary Impact Area: Quality Jobs An Indigenous-led company that transforms organic waste into high-quality soil products, promoting sustainability and community empowerment. Primary Impact Area: Sustainable Land Management Secondary Impact Areas: Waste Management; Racial Equity; Quality Jobs A Canadian training provider specializing in technical rescue, safety, medical and emergency services for industrial, resource and public-service clients. Primary Impact Area: Quality Health Care Secondary Impact Area: Climate Adaptation and Resilience An online platform that provides comprehensive treatment for ADHD, depression, anxiety, insomnia and more using virtual medical appointments, coaching, and medication delivery. Primary Impact Area: Quality Health Care Provides virtual assistants and a seamless software platform to help health practitioners streamline administrative workflows, reduce overhead and more. Primary Impact Area: Quality Health Care Develops safer, more affordable, zero-emission marine robotic systems for collecting and managing oceanographic and maritime data. Its autonomous robotic data collection platform and cloud-based software system provide real-time data acquisition with AI driven analytics. Primary Impact Area: Climate Change Mitigation Secondary Impact Area: Marine Resources Conservation and Management A lightning prevention company that stops wildfires caused by lightning. It uses AI weather modelling to identify high-risk storms and lightning events in advance, and government approved methods to neutralize the electrical potential in clouds. Primary Impact Area: Climate Change Mitigation An Indigenous technology company that develops custom software and enterprise-grade content management systems (CMS) designed to meet the unique needs of Indigenous organizations. Its flagship product supports Indigenous data sovereignty by enabling secure, community-controlled data infrastructure. Primary Impact Area: Racial Equity Secondary Impact Area: Quality Jobs Converts under-utilized urban land in Victoria, BC into urban farms, supplying fresh produce and supporting food-security education. Primary Impact Area: Smallholder Agriculture An organization that uses research to help households and institutions measure and improve financial well-being. Primary Impact Area: Financial Inclusion A retailer in Penticton selling local organic produce and bulk foods while minimizing packaging waste and supporting regional farms. Primary Impact Area: Smallholder Agriculture Secondary Impact Area: Sustainable Agriculture Implements community-based food programs, including urban agriculture and food distribution, to enhance food security and promote healthy eating in the Comox Valley region. Primary Impact Area: Smallholder Agriculture Creates non-toxic, biodegradable, enzyme-powered light sticks as sustainable alternatives to chemical light and traditional glow sticks, aiming to reduce plastic waste and environmental impact. Primary Impact Area: Waste Management Secondary Impact Area: Pollution Prevention Provides digital support and platform development to entrepreneurs, empowering them to bring their boldest ideas to life through education, entertainment, community, technology, and heart-centered strategy. Primary Impact Area: Quality Jobs A nonprofit housing cooperative organization that develops affordable, sustainable, net-zero housing in Kamloops, with a goal of building a network of affordable multi-family buildings over the next several decades. Primary Impact Area: Financial Inclusion Provides a digital platform for nonprofits and charities to create, grow, and manage fundraising events, streamlining donation processes and enhancing community engagement. Primary Impact Area: Financial Inclusion Supports local food producers, offers community kitchen spaces, and promotes healthy and sustainable food systems to vulnerable populations in BC's Capital Region. It works to increase community resources, food skills, and social connections for a healthier future. Primary Impact Area: Smallholder Agriculture Secondary Impact Areas: Quality Jobs; Racial Equity A first-time fund manager led by members of the 2SLGBTQI+ community. Its Misfit Ventures Fund I is investing in early-stage technology ventures led by 2SLGBTQI+ founders, with a focus on intersectional equity-deserving groups and those operating in impactful sectors. Primary Impact Area: Financial Inclusion An established fund manager. Its NMF Rental Housing Fund II partners with nonprofits across Canada to take ownership of and improve existing housing stock and to create new affordable housing developments, in an environmentally sustainable way. Primary Impact Area: Affordable Housing Secondary Impact Area: Energy Efficiency An Indigenous-led established fund manager. Manages Raven Indigenous Opportunities Fund I, which provides follow-on capital to Indigenous-owned and led companies. Primary Impact Area: Racial Equity Secondary Impact Areas: Quality Jobs; Waste Management; Sustainable Land Management A first-time fund manager. Its Regenerative Capital Group Fund I supports entrepreneurial leaders to acquire Canadian businesses as platforms for meaningful impact, growth, purpose and profit. Primary Impact Area: Quality Jobs Secondary Impact Area: Climate Change Mitigation; Energy Efficiency; Financial Inclusion; Racial Equity A woman-led first-time fund manager. Its Relentless Health Pursuit Fund is investing in early-stage companies led by members of equity-deserving groups that are developing technologies addressing gaps in preventative health and chronic disease management associated with aging. Primary Impact Area: Quality Healthcare A first-time fund manager. Its Spring Impact Capital Fund I invests in and supports early-stage Canadian ventures led by values-driven, diverse teams. Primary Impact Area: Quality Health Care Secondary Impact Areas: Financial Inclusion; Marine Resources Conservation and Management; Climate Change Mitigation A woman-led emerging fund manager. Its Thrive Impact Fund provides patient debt capital and revenue-based financing to social enterprises, nonprofits, charities and co-ops based in small communities throughout British Columbia. Primary Impact Area: Community Development Secondary Impact Areas: Quality Jobs; Racial Equity; Arts and Culture; Climate Adaptation and Resilience; Smallholder Agriculture; Community Development; Pollution Prevention; Financial Inclusion; Waste Management; Sustainable Water Management We have provided market-building support to one organization based in the Northwest Territories, as of June 2025. Operates a full-service medical billing software and claim-submission system that gives physicians real-time insights and automates billing workflows. Primary Impact Area: Quality Health Care An Indigenous-led company offering a virtual assistant marketplace that connects businesses with skilled, remote professionals from diverse backgrounds across Canada and the U.S. Primary Impact Area: Racial Equity Secondary Impact Area: Quality Jobs Uses virtual reality hardware and software to make vision exams more accessible and affordable, particularly in underserved communities. Primary Impact Area: Quality Health Care Delivers an AI-powered helpdesk platform tailored for agricultural equipment dealers to streamline customer experience from purchase to repair. Primary Impact Area: Smallholder Agriculture Secondary Impact Area: Quality Jobs Is building a digital agricultural platform to increase competitiveness in Canada's agricultural sector by improving margins for growers and providing access to innovative products. The company will support all aspects of the supply chain including procurement, logistics, inventory management, payment processes and financing for transactions. Primary Impact Area: Smallholder Agriculture Secondary Impact Area: Financial Inclusion Produces phycocyanin, a completely natural blue pigment that can safely replace artificial colour additives in food and beverage items. Primary Impact Area: Climate Change Mitigation Secondary Impact Areas: Sustainable Agriculture; Sustainable Water Management A woman-led, first-time fund manager. It is a joint venture of The51 and CNSRV-X. Its The51 Food and AgTech Fund I invests in Canadian tech companies led by women and diverse teams that are addressing climate challenges. Primary Impact Area: Financial Inclusion Secondary Impact Areas: Climate Change Mitigation; Sustainable Agriculture; Waste Management; Climate Adaptation and Resilience; Pollution Prevention We have provided market-building support to five Alberta-based organizations, as of June 2025. Develops AI and robotics technologies for agriculture, aiming to create more efficient, resilient and profitable farms through automation and data. Primary Impact Area: Sustainable Agriculture A first-time Indigenous-led fund manager. Its Flowing River Capital Fund I is bringing Indigenous ownership and leadership to companies it invests in, buys and manages. A member-owned car-sharing service offering nearly 200 vehicles. Primary Impact Area: Community Development Secondary Impact Area: Climate Change Mitigation A social enterprise that carries out repair/rehabilitation of social housing and builds new accessible, energy-efficient affordable homes while training tradespeople with barriers to employment. Primary Impact Area: Affordable Housing A rental property in Winnipeg with 72 studio, one- and two-bedroom apartments. Primary Impact Area: Affordable Housing An established product issuer. Its community lending program supports charities and nonprofits focused on poverty reduction. Primary Impact Area: Affordable Housing Secondary Impact Areas: Food Security, Quality Education We have provided market-building support to one Manitoba-based organization, as of June 2025. Operates a Canadian digital pharmacy and care-platform that delivers prescriptions, diabetes supplies and care products directly to users managing diabetes. Primary Impact Area: Quality Health Care Delivers a software platform for auto-dealerships to sell electric vehicles, retain service customers and appraise EVs with precision tools. Primary Impact Area: Climate Change Mitigation A low-carbon rental home project in Orillia that includes 48 sustainably designed one- and two-bedroom homes with all-electric heat pump mechanical systems and solar PV panels. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience A 12-storey apartment project in Scarborough featuring low carbon rental homes designed with natural, climate-safe materials and all-electric mechanical systems. The site includes geothermal heating and cooling systems, and solar PV panels. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience A low-carbon rental home project comprised of one, two and three-bedroom homes. The site includes all-electric heat pump mechanical systems, electric barbeques and solar PV panels. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience An 11- and 6-storey connected, low-carbon rental apartment project in Scarborough that includes multi-purpose spaces, all-electric geothermal heating and cooling and solar PV panels. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience A mixed-tenure residential development project in Ottawa with 81 townhouses and walk-up apartments built with energy-efficient design. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience A large-scale rental housing development in Mississauga of 250 apartments across two new 12-storey towers alongside an existing seven-storey building. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience Offers an automated additive manufacturing solution (or 3D printing) for polymer parts and emblems enabling cost-competitive local manufacturing. Primary Impact Area: Climate Change Mitigation Offers remote HVAC software that maximizes the performance of existing HVAC systems in real-time. The software optimizes and automates building equipment controls, such as temperature set points, run times, and motor speeds, to save energy costs and reduce GHG emissions. Primary Impact Area: Energy Efficiency An 82-unit residential building in Toronto offering affordable and mixed-market units. Primary Impact Area: Affordable Housing A 21-unit rental property in Hamilton that provides housing for a mix of low- and moderate-income households. Primary Impact Area: Affordable Housing Develops personalized pelvic devices to improve pelvic health care for women by tailoring each device to the patient’s anatomy. Primary Impact Area: Quality Health Care Creates evidence-based digital therapeutics using AI-personalized music, helping unlock the power of sound and music to help those facing mental health challenges. Primary Impact Area: Quality Health Care Specializes in developing plant-based biomaterials as sustainable alternatives to traditional plastics, accelerating the design of scalable, high-performance materials tailored for global brands across various industries. Primary Impact Area: Climate Change Mitigation Secondary Impact Areas: Pollution Prevention; Waste Management Combines modern and traditional genetic engineering to produce higher-yielding crops that are resistant to climate challenges. The modularized technology enables the custom design of crops based on market needs, from single target gene editing to multiple trait stacking. Primary Impact Area: Climate Change Mitigation Secondary Impact Area: Sustainable Agriculture Develops eco-friendly, 100% plant-based firefighting gels that replace toxic foams, offering safer solutions for fire suppression while protecting the environment and reducing water usage. Primary Impact Area: Climate Adaptation and Resilience A digital media and learning organization that publishes stories, research and insights aimed at strengthening the social-purpose and nonprofit sector in Canada. Primary Impact Area: Quality Jobs Secondary Impact Areas: Resilient Infrastructure A Canadian coalition that aims to build inclusive social-economy ecosystems by advancing diversity, equity and access within social finance and cooperative networks. Primary Impact Area: Quality Jobs Secondary Impact Areas: Resilient Infrastructure A women-led established fund manager. Manages Amplify Capital Fund III, which is investing in scalable impact-focused tech ventures. Primary Impact Area: Quality Health Care Secondary Impact Areas: Climate Change Mitigation; Quality Education A women-led, established fund manager. Through its Fund IV it is partnering with Canadian farmers to invest in land, inputs and equipment, and enhance the viability and sustainability of operations. Primary Impact Area: Smallholder Agriculture Secondary Impact Areas: Sustainable Agriculture A first-time fund manager that has partnered with Kindred Works, a socially minded developer and property manager. It is investing in the development of new affordable and mixed-income rentals, built to high environmental standards. Primary Impact Area: Affordable Housing Secondary Impact Areas: Climate Change Mitigation; Climate Adaptation and Resilience An Indigenous-led, woman-led, first-time fund manager. Its Fund I is providing short-term financing for nonprofit affordable housing projects driven by and for Indigenous communities. Primary Impact Area: Affordable Housing Secondary Impact Areas: Community Development An immigrant-led first-time fund manager. Maple Bridge Ventures Fund I is investing in immigrant-led ventures, focused on health and sustainability. Primary Impact Area: Financial Inclusion An emerging fund manager. Its PaceZero Sustainable Credit Fund II is lending to early-stage tech companies developing and commercializing innovative technologies that generate positive environmental or social impact. Primary Impact Area: Climate Change Mitigation Secondary Impact Areas: Sustainable Agriculture A first-time fund manager. Weave was created by and is owned by Tapestry Community Capital, an established community bond service provider. Its Weave Community Capital Fund is a large, pooled fund that enables investors to support many positive community bond projects across Canada with one investment. Primary Impact Area: Affordable Housing Secondary Impact Area: Community Development A woman-led, established product issuer. Its Windmill Community Bond provides microloans to foreign-educated professionals so they can work in the field they trained in before coming to Canada. Primary Impact Area: Financial Inclusion Secondary Impact Area: Quality Jobs We have provided market-building support to 23 Ontario-based organizations, as of June 2025. Offers a continuous cardiovascular care platform combining AI, clinical-expert insight and sensors to enable early action for people with heart conditions. Primary Impact Area: Quality Health Care Develops smart home energy systems that allow homeowners to generate, store, and manage renewable energy. The company combines hardware and software in a complete solution enabling vehicle-to-home and vehicle-to-grid energy management. Primary Impact Area: Climate Change Mitigation Upcycles organic waste into valuable agricultural products through an innovative insect-based farming process. The company farms Black Soldier Fly larvae to produce animal feed (proteins and oils) and organic fertilizer. Primary Impact Area: Climate Change Mitigation Provides software-based, dynamic LED lighting solutions tailored to the controlled environment agriculture (CEA) industry that address the specific needs of crops at various stages of growth through tailored light treatments. Primary Impact Area: Climate Change Mitigation Develops short-range wireless transceivers that enable fast, low-power data transfer with minimal delay and reduced electromagnetic interference for applications like wireless audio, gaming devices, and IoT sensors. Primary Impact Area: Energy Efficiency A vertically integrated provider of energy-efficient HVAC systems serving mission critical industries, such as data centres and healthcare. Primary Impact Area: Energy Efficiency A Montreal property with 47 affordable rental housing units, consisting of bedroom sizes ranging between studios to three-bedrooms. Primary Impact Area: Affordable Housing Two housing properties in Longueuil, include 60 affordable rental housing units, consisting of a variety of bedroom sizes ranging between studios to three-bedrooms. Primary Impact Area: Affordable Housing A Montreal building of 715 apartments, 3 community rooms and 2 offices. Primary Impact Area: Affordable Housing 313 affordable apartments in Drummondville, from studio to three-bedroom apartments. Primary Impact Area: Affordable Housing Designs and manufactures water-pathogen monitoring systems for cooling towers to enable rapid detection and intervention. Primary Impact Area: Quality Health Care Commercializes waste-derived biosurfactants produced from food-waste feedstocks, delivering sustainable ingredients for cleaning, cosmetics and industrial products. Primary Impact Area: Climate Change Mitigation Secondary Impact Area: Waste Management An established fund manager. Its Idealist Climate Impact Fund is investing in scalable, commercially ready solutions in Canada, particularly Quebec, that decarbonize power supply, electrify transportation and help the transition to a circular economy. Primary Impact Area: Climate Change Mitigation Secondary Impact Area: Energy Efficiency We have provided market-building support to 12 Quebec-based organizations, as of June 2025. We have provided market-building support to 3 Nova Scota-based organizations, as of June 2025. Develops carbon dioxide removal solutions using ocean alkalinity enhancement to sequester ocean carbon while improving ocean chemistry for marine life. Primary Impact Area: Climate Change Mitigation We have provided market-building support to one New Brunswick-based organization, as of June 2025. We have provided support to one project aiming to build the social finance market in Newfoundland and Labrador, as of June 2025.

British Columbia (click dots to learn more)

Portfolio company, Amplify Capital Fund III

Market Building

Portfolio company, Raven Indigenous Opportunities Fund I

Portfolio company, Raven Indigenous Opportunities Fund I

Portfolio company, Regenerative Capital Group Fund I

Portfolio company, Spring Impact Capital Fund I

Portfolio company, Spring Impact Capital Fund I

Portfolio company, Spring Impact Capital Fund I

Portfolio company, Spring Impact Capital Fund I

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Misfit Ventures

New Market Funds

Raven Indigenous Capital Partners

Regenerative Capital Group

Relentless Pursuit Management

Spring Impact Capital

Thrive Impact

Northwest Territories (click dots to learn more)

Market Building

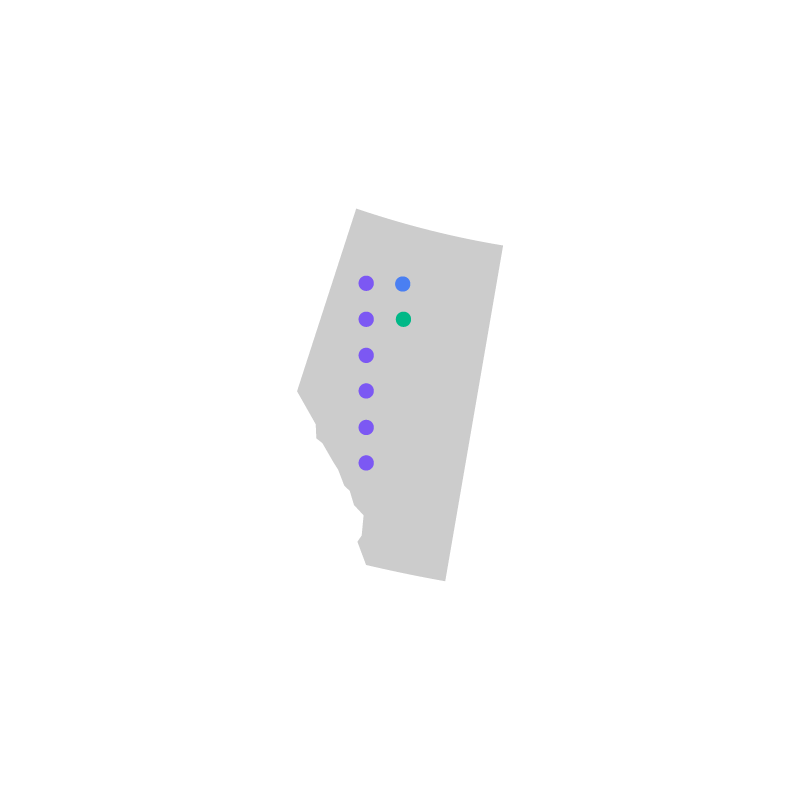

Alberta (click dots to learn more)

Portfolio company, PaceZero Sustainable Credit Fund II

Portfolio company, Raven Indigenous Opportunities Fund I

Portfolio company, Spring Impact Capital Fund I

Portfolio company, The51 Food and AgTech Fund I

Portfolio company, The51 Food and AgTech Fund I

Portfolio company, The51 Food and AgTech Fund I

NYA Ventures

Market Building

Saskatchewan (click dots to learn more)

Portfolio company, The51 Food and AgTech Fund I

Flowing River Capital

Manitoba (click dots to learn more)

An enterprise that has received a loan from Jubilee Fund

An enterprise that has received a loan from Jubilee Fund

Portfolio Holding, NMF Rental Housing Fund II

Jubilee Fund

Market Building

Ontario (click dots to learn more)

Portfolio company, Amplify Capital Fund III

Portfolio company, Amplify Capital Fund III

Portfolio holding, Heartwood Trust

Portfolio holding, Heartwood Trust

Portfolio holding, Heartwood Trust

Portfolio holding, Heartwood Trust

Portfolio holding, Heartwood Trust

Portfolio holding, Heartwood Trust

Portfolio company, Idealist Climate Impact Fund

Portfolio company, Idealist Climate Impact Fund

Portfolio holding, NMF Rental Housing Fund II

Portfolio holding, NMF Rental Housing Fund II

Portfolio company, PaceZero Sustainable Credit Fund II and Spring Impact Capital Fund I

Portfolio company, PaceZero Sustainable Credit Fund II

Portfolio company, The51 Food and AgTech Fund I

Portfolio company, The51 Food and AgTech Fund I

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Portfolio company, Thrive Impact Fund

Amplify Capital Partners

Area One Farms

Heartwood Trust

Keewaywin Capital

Maple Bridge Ventures

PaceZero Capital Partners

Weave Community Capital

Windmill Microlending

Market Building

Quebec (click dots to learn more)

Portfolio company, Amplify Capital Fund III

Portfolio company, Idealist Climate Impact Fund

Portfolio company, Idealist Climate Impact Fund

Portfolio company, Idealist Climate Impact Fund

Portfolio company, Idealist Climate Impact Fund

Portfolio company, Idealist Climate Impact Fund

Portfolio holding, NMF Rental Housing Fund II

Portfolio holding, NMF Rental Housing Fund II

Portfolio holding, NMF Rental Housing Fund II

Portfolio holding, NMF Rental Housing Fund II

Portfolio company, Spring Impact Capital Fund I

Portfolio company, The51 Food and AgTech Fund I

Idealist Capital

Market Building

Nova Scotia (click dots to learn more)

Market Building

Portfolio company, Amplify Capital Fund III

New Brunswick (click dots to learn more)

Market Building

Newfoundland and Labrador (click dots to learn more)

Market Building

Sustainable Development Goals

A key goal of the Social Finance Fund, and therefore Realize Fund I, is to contribute to the United Nations’ Sustainable Development Goals (SDGs). The SDGs are a plan to promote prosperity while protecting the environment. The 17 interconnected goals set out how to deliver global sustainable development.

SDG contribution has been building since we began investing in 2023 and Fund I now shows a broad foundation of contribution across goals. Contributions in the first half of 2025 were mostly to people-focused goals, building on contributions from 2023 and 2024; for example, the SDG graph shows strong contribution in the first half of 2025 to SDG 3: Good Health and Well-Being and SDG 11: Sustainable Cities and Communities.

SDG Contributions, Fund I Portfolio Holdings (June 2025)

Note: SDG contributions are determined through fundamental analysis. We review fund manager annual surveys alongside our impact thesis to arrive at a conclusion about SDG contribution. If a holding contributes to more than one SDG, we establish a primary SDG and non-primary SDGs, based on the significance of activities using research and analysis. For primary SDGs we also determine the underlying SDG target in order to fully understand impact. For young products, our assessment regarding SDG contribution may be a forward-looking expectation.

Impact Areas

Our investment and market-building activities are reaching many areas.

Fund I is a sector-agnostic fund. Our efforts to invest across sectors and impact areas is due to our systemic and intersectional approach to growing Canada’s social finance market and addressing large pressing challenges, which we believe require solutions from multiple angles. Since inception, Fund I has been invested in a range of impact areas that support positive environmental and social outcomes. In the first half of 2025, contributions to the areas of affordable housing and community development were significant.

Our market-building activities have supported 60 groups (through 96 engagements), which are working across a broad range of impact areas.

Impact Areas, Realize Fund I Portfolio Holdings (June 2025)

Note: Impact areas are determined through fundamental analysis. We examine a holding’s activities and connect them to impact areas. In cases where a fund has not yet deployed capital or has made only one or two investments, we allocate the uncalled commitment based on the fund’s stated impact intention. As funds deploy more capital, we are able to deepen our understanding, based on reported activities not just intentions.

Impact Areas, Market-Building Activities (June 2025)

Target Populations

Through our investment and market-building activities, we aim to reach under-served populations.

As of June 2025, Realize Fund I has committed to 19 investments. These investments sometimes focus on the environment only (two so far) or the general population but most aim to benefit specific groups of people, some funds more than one group. 14 of the 19 SFIs (74%) are targeting one or more equity-deserving groups.

As of June 2025, our marketing-building activities have supported 60 groups. Many of those groups are themselves aiming to support particular groups of people.

Targeted Populations, Realize Fund I Portfolio Holdings (June 2025)

Targeted Populations, Market-Building Recipients (June 2025)