Insights

A Year of Progress in our Investment Portfolio

By Lars Boggild, Portfolio Manager, Realize Fund I

December 2025

2025 was a full and successful year for Realize Fund I and our wider team.

Portfolio Size Grew 23% and Continues to Diversify

During the year, we committed $16.5M to new Social Finance Intermediaries (SFIs) aligned with our long-term deployment plan while continuing to work with and support our existing portfolio. A further $22.3M in investments are actively in later stages of our investment process, supporting significant capital deployment in the quarters ahead.

Our latest commitments and investment priorities continue to diversify Fund I’s portfolio, adding exposure to more mature companies through private equity and private credit, and complementing our growing and increasingly diverse exposure to the Canadian innovation economy. New commitments enhance our exposure to sectors with strong commercial and impact potential, such as life sciences and healthtech. They also deepen our contributions to advancing social equity through strategies that specifically support women and other equity-deserving groups.

These 2025 commitments brought the portfolio to a cumulative $87.8M in commitments across 21 SFIs (of which 19 are public on our portfolio page).

SFIs Hit Key Milestones

We’ve been pleased with some meaningful progress within the portfolio, highlighting just a few examples such as:

- New investment milestones by partners such as Idealist Capital driving climate mitigation outcomes and PaceZero Capital Partners enabling innovative housing solutions

- New fund launches by Weave Community Capital, helping grow the market of vehicles that can reach across Canada and resource mission driven organizations

- Fund closes reached by Spring Impact Capital, Keewaywin Capital, and Maple Bridge Ventures alongside strong investors from the institutional and philanthropic community

- Major campaign launches by Windmill Microlending, to support thousands of skilled immigrants to Canada to apply their talents in critical industries such as healthcare

- Ongoing thought leadership and sector contributions by many, such as Misfits Ventures shining a spotlight on the challenges of 2SLGBTQIA+ founders in this moment in North America

We encourage you to look through our recently refreshed impact page, which highlights outcomes in progress. As our investments continue, and our portfolio of SFIs deploy capital, these outcomes will continue to grow.

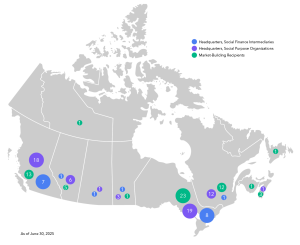

We Continued to Work to Build the Market

Our wider team has continued to lead on activities that complement and enhance our investment strategy while growing the wider impact investing market. Through our investment activity we’re reaching 80 organizations; through our market-building programs, 59 groups (96 engagements). Building on existing work, in 2025 we deepened our Impact Measurement and Management training for all Social Finance Fund participants. We completed an RFP to provide targeted grant support to proponents looking to develop investment solutions that blend private, philanthropic, or government capital to achieve stronger commercial and impact outcomes, and recently announced the recipients. We were also pleased to host “The Nature Pitch” as part of the Canadian Climate Week Xchange to highlight organizations looking to engage private investors to drive positive financial and environmental outcomes in natural assets, which built on earlier RFP results announced early in the year.

We will continue to seek opportunities to make strategic resources available to address market gaps in available investments, strengthen the capabilities of existing SFIs, and enhance the ability of partners to manage towards positive outcomes. If you haven’t had the opportunity, we encourage you to take a moment to get inspired with some more first-hand perspectives from some of our investee and grantee partners through our video series “Meet the Change”. These are focused snapshots (literally around a minute!), so well worth the time.

The New Year Will Bring New Investments and New Partners

Looking to 2026, we are excited by the year ahead. We are continuing to actively invest across private market impact investing funds and are thrilled to continue to construct a portfolio which systemically responds to many Canadian challenges while advancing social equity. We have continued to see strong origination of new SFI relationships among both more established SFIs as well as new and emerging SFIs. Through 2025, over 75 new opportunities entered our investment universe, with many on a clear path to launch in 2026. We likewise continue to see novel investment strategies with clear theses to drive commercial returns and positive social or environmental outcomes in areas such as healthcare innovation and green building technologies. We have continued to map our existing investments for exposure across different sectors and themes and look forward to building an increasingly diverse and resilient portfolio. We expect strong deployment in 2026 and over the following two to three years, building on the foundation and activities of this year.

Building on the fundraising momentum of the year, we look forward to welcoming new investors to our growing network of partners as well, as we close out our fundraising at the end of Q1 2026. We look forward to growing Realize Fund I with these partners, deepening our capacity to invest in and grow the Canadian impact investing market, and ultimately strive to drive more resources to entrepreneurial, mission-driven leaders with a goal to advance a more sustainable and inclusive economy.

RELATED CONTENT

RELATED CONTENT